Is Life Alert Worth the Money?

If you’re looking for peace of mind and the assurance that help is always just a button press away, a Life Alert system may be a wise investment for you or your loved one. Life Alert is one of the most well-known medical alert companies, with over 30 years of experience in the industry. They offer a variety of products and services designed to help seniors stay safe and independent in their own homes, including 24/7 monitoring, emergency response, and medication reminders.

Our health and mobility can decline as we age, making us more susceptible to accidents and emergencies. Many turn to personal emergency response systems like Life Alert to ensure seniors can get help quickly in danger.

While the cost of a Life Alert system may seem high, it’s important to consider the potential cost of not having one. In an emergency, a medical alert system can be a lifeline, providing immediate access to help when needed. Additionally, many insurance companies may offer discounts for medical alert systems, which can help offset the cost.

Overall, if you’re looking for peace of mind and the assurance that help is always just a button press away, a Life Alert system may be a wise investment for you or your loved one.

What is Life Alert?

Life Alert is a personal emergency response system that provides seniors access to emergency medical assistance 24/7. It consists of a wearable device with a button that, when pressed, connects the user to a monitoring center.

Once the user presses the button, a certified emergency medical dispatcher will speak to them via a two-way speaker system in the device. The dispatcher can then send help to the user’s location, whether an ambulance, fire department, or police.

How Much Does Life Alert Cost?

The cost of Life Alert can vary depending on the level of coverage selected. Here are some of the pricing details for Life Alert:

In-Home Landline Unit

This plan includes a base unit that connects to a landline telephone and a waterproof emergency button that can be worn as a necklace or bracelet. The cost starts at around $20 per month.

In-Home Cellular Unit

This plan includes a base unit that uses cellular technology and a waterproof emergency button that can be worn as a necklace or bracelet. The cost starts at around $30 per month.

Mobile with GPS

This plan includes a mobile device with GPS tracking technology and a waterproof emergency button that can be worn as a necklace or bracelet. The cost starts at around $40 per month.

Ultimate Plan

This plan includes all the above features, fall detection technology, and smoke and carbon monoxide detectors. The cost starts at around $50 per month.

It’s important to note that additional costs may be associated with installing the Life Alert system, including an activation fee and equipment fee. Some plans may require a long-term contract commitment, while others offer month-to-month subscriptions. Before signing up for Life Alert, read the terms and conditions carefully and understand all associated costs.

What are Life Alert System Key Product Features?

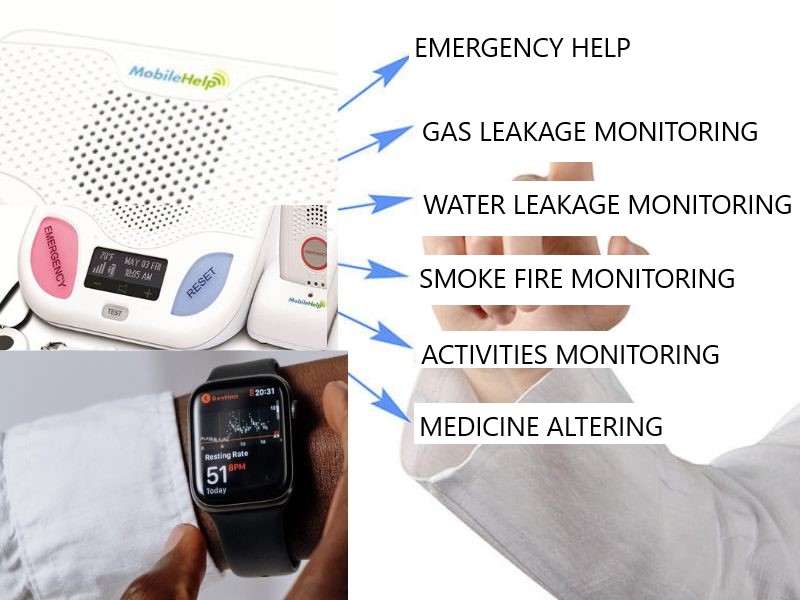

Life Alert offers several key features to assist seniors and others with limited mobility or medical conditions. Some of the key product features of Life Alert include:

- 24/7 Emergency Response: Life Alert’s emergency response center is staffed 24/7 by trained professionals who can quickly dispatch emergency medical services.

- In-Home Base Unit: Life Alert’s in-home base unit connects to a landline telephone and allows users to speak with emergency responders directly in an emergency.

- Mobile Device: The Preferred and Ultimate plans include a mobile device users can take outside the home. This device uses cellular technology to connect to the emergency response center and can provide GPS location information to responders.

- Fall Detection: Life Alert’s Ultimate plan includes fall detection technology that can automatically detect falls and alert emergency responders, even if the user cannot press the emergency button.

- Fire and CO2 Protection: Life Alert offers smoke and carbon monoxide detectors that can alert emergency responders in the event of a fire or CO2 leak.

- Spouse Coverage: Life Alert’s spouse coverage option allows both spouses to be covered under a single subscription.

These features provide peace of mind to seniors and their families by ensuring that emergency medical assistance is always available when needed. However, it’s important to note that not all of these features are available with every Life Alert plan, and costs can vary depending on the level of coverage selected.

Should You Invest In a Life Alert System?

Here are some pros and cons to consider:

Pros:

- Provides quick access to emergency medical assistance 24/7

- Easy to use for seniors, with a one-button operation

- Can give peace of mind to family members who may worry about their loved one’s safety

Cons:

- Can be expensive, with monthly fees and upfront costs

- Requires a landline telephone or mobile device with a strong signal to work

- May not be necessary for seniors who have caregivers or live in assisted living facilities

Ultimately, whether or not Life Alert is worth the money will depend on your circumstances. It may be a worthwhile investment if you live alone and have limited mobility or medical conditions that could lead to emergencies. However, it may not be necessary if you have family members or caregivers who can help you in an emergency.

FAQs

How does Life Alert differ from other personal emergency response systems?

Life Alert is one of the market’s most well-known personal emergency response systems, but it is not the only option. Other systems like Medical Guardian and Philips Lifeline offer similar services with different features and pricing.

How reliable is Life Alert?

Life Alert has been in business for over 30 years and has a good reputation for reliability. However, like any technology, it can sometimes have technical or connection problems.

Does Life Alert work outside the home?

Most insurance plans, including Medicare and Medicaid, do not cover the cost of Life Alert. However, some long-term care insurance policies may cover the cost.

Can I cancel my Life Alert subscription at any time?

Yes, you can cancel your Life Alert subscription at any time. However, you may be required to pay an early termination fee if you cancel before the end of your contract term. It’s essential to read the terms and conditions of your contract carefully before signing up for the service.

Bottom Line

Life Alert can be a valuable investment for seniors who live alone and have limited mobility or medical conditions that could lead to emergencies. It provides quick access to emergency medical assistance 24/7 and can give peace of mind to family members who may worry about their loved one’s safety.

However, whether or not Life Alert is worth the money will depend on your circumstances. It may be optional if you have family members or caregivers who can help you in an emergency. Additionally, the monthly fees and upfront costs can be expensive, and the system requires a landline telephone or mobile device with a solid signal to work.

If you are considering purchasing a personal emergency response system, research your options and compare prices and features. Ultimately, the goal is to find a plan to provide you with the safety and security you need while fitting within your budget.