Is Life Alert FSA Eligible?

Yes, Life Alert medical system is eligible for reimbursement through a Flexible Spending Account (FSA) or Health Savings Account (HSA) in most cases.

Medical alert systems like Life Alert are considered to be a form of durable medical equipment, which means they are typically eligible for reimbursement through an FSA or HSA. However, it is important to check with your FSA or HSA provider to confirm their specific guidelines for reimbursement of medical alert systems.

You may need to provide documentation, such as an itemized receipt or letter of medical necessity, to receive reimbursement for the cost of a Life Alert medical system through your FSA or HSA.

Are you considering investing in a Life Alert device to help keep your loved one safe and secure? If so, you must take the time to understand how these devices are covered by Flexible Spending Accounts (FSA). This program offers many benefits for those eligible, which can make a big difference in ensuring your family member has the right level of future protection.

Here we will provide an overview of what FSA programs cover regarding Life Alert systems so you can make the most informed decision possible.

What is Life Alert System?

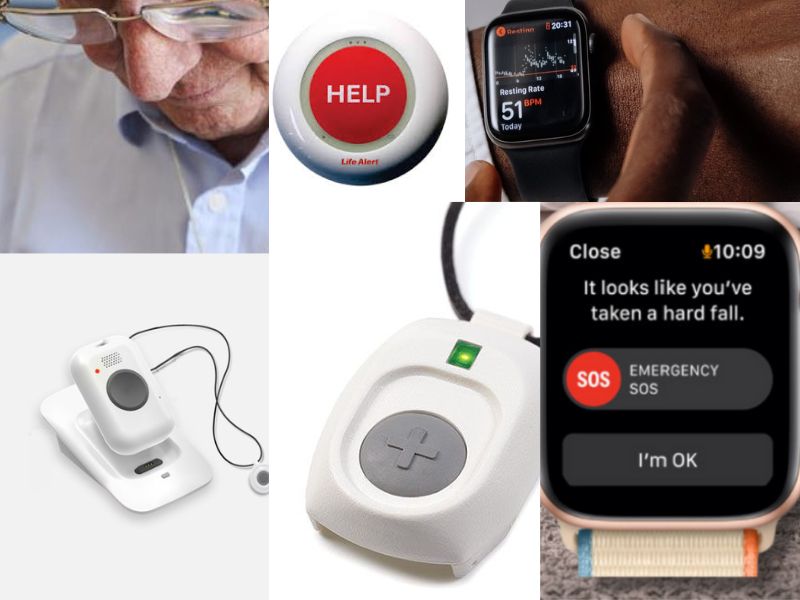

Life Alert is a medical alert system designed to help and support elderly individuals and people with disabilities. The device is equipped with a panic button that can be used to summon help in case of an emergency, such as a fall or medical issue. The system is typically connected to a base unit equipped with two-way voice communication and a 24/7 monitoring center.

In an emergency, the monitoring center can speak with the individual through the base unit and dispatch the appropriate help, such as paramedics or family members. Life Alert aims to provide peace of mind and independence to its users by ensuring that help is just a button press away in case of an emergency.

What are the Pros and Cons of Life Alert Systems?

Pros of Life Alert System:

- Quick Response: The Life Alert system provides quick response in the case of an emergency, with its 24/7 monitoring center always on standby to help.

- Peace of Mind: Knowing that help is just a button press away can give users and their families peace of mind and improve their overall quality of life.

- Independence: Life Alert allows elderly individuals and people with disabilities to live independently and confidently without relying on family members or caregivers for assistance.

- Versatility: Life Alert offers a range of devices and systems that can be customized to meet the specific needs of each user, providing versatility and flexibility.

- Reliability: The Life Alert system is designed to be reliable and efficient, ensuring that help will be available whenever needed.

Cons of Life Alert System:

- Cost: The Life Alert system can be a significant expense, especially for individuals on a fixed income.

- Limited Range: The Life Alert system is typically limited to a specific range, meaning that it may not work in areas outside of the home.

- False Alarms: In some cases, false alarms can occur, which can be disruptive and stressful for both the user and the monitoring center.

- Complexity: The Life Alert system can be complex and challenging to use, especially for those who need to be technologically savvy.

- Dependence: Some users may become too dependent on the Life Alert system, limiting their independence and ability to manage their affairs.

It’s essential to consider the life-alert system’s pros and cons before deciding. While it can provide a valuable source of support and help in emergencies, it is also essential to consider the system’s cost and potential limitations.

What is a Flexible Spending Account (FSA)?

A flexible spending account (FSA) is a type of health savings account that allows you to use pre-tax dollars to pay for eligible medical expenses. The funds in your FSA can be used to pay for a wide range of medical expenses, including copays, deductibles, and other out-of-pocket costs.

Eligible Medical Expenses

To determine whether Life Alert is FSA eligible, it’s essential to understand what expenses qualify for FSA reimbursement. The Internal Revenue Service (IRS) provides a list of eligible medical expenses that includes many items, including medical alert systems.

According to the IRS, medical alert systems are considered eligible expenses if used to help individuals with disabilities or chronic conditions. In this case, Life Alert would be considered a qualified expense as it is specifically designed for individuals needing help in an emergency.

Using Your FSA to Pay for Life Alert

Once you have determined that Life Alert is FSA eligible, you can use your FSA to pay for the system. To do this, you will need to provide proof of purchase and a receipt for the system to your FSA administrator. The administrator will then reimburse you for the expense, deducting the funds from your FSA balance.

It’s important to note that the amount you can spend on your Life Alert system will depend on the balance in your FSA. You should also be aware that if you use all of the funds in your FSA by the end of the year, you will retain them. This is why it’s essential to plan your FSA expenses carefully and ensure that you have enough funds to cover the cost of your Life Alert system.

Conclusion

In conclusion, Life Alert is FSA-eligible and can be paid using your flexible spending account. To take advantage of this option, you will need to provide proof of purchase and a receipt for the system to your FSA administrator. Using your FSA to pay for Life Alert can save money on your medical expenses and ensure that you have the help and support you need in an emergency.

A flexible spending account can be a valuable resource for individuals who need help paying for medical expenses, including Life Alert systems. If you have questions about your FSA or the process for paying for Life Alert, you must reach out to your FSA administrator for guidance.